Alan Alexandroff, John Gruetzner and Stephen Zhao

This year, for the first time in 40 years, the world experienced an arrest in the seemingly exorable growth of CO2 emissions. Annual Chinese emissions also followed this trend, and the reduction in emissions is no doubt partly responsible for the overall bend in the curve on CO2 emissions. In fact, China experienced a 1% reduction in emissions, its first decline since 2001. This is a positive development, reflecting in part China’s major carbon intensity reductions. The effort resulted in a 5% reduction in carbon intensity during just the first half of 2014. Additionally the carbon reduction reflects China’s slowing economy, which grew at approximately 7%, which though significant is a major deceleration from decades of double digit growth. However, this year’s decline is unlikely to mean that China’s downward carbon trend is likely to become the norm: the low-hanging fruit in Chinese emissions reduction are quickly running out. It is crucial, therefore, that China intensify its efforts to control carbon emissions if we are to see a continuation in the trend toward lower carbon emissions.

A National Emissions Trading Scheme (ETS) for China

To achieve a continuing decline in carbon levels, China policy makers are now planning to implement a national ETS scheme next year to try and reign in and then eventually reduce its greenhouse gas emissions. This national effort comes after China launched seven pilot ETS projects across the country beginning in 2013: Beijing, Shanghai, Tianjin, Guangdong, Shenzhen, Hubei, and Chongqing. China Perspectives has described the ETS pilot projects here at the site. Currently, China plans to implement a national ETS in 2016. Originally set for implementation in 2020, the national ETS has been brought forward to coincide with the unveiling in 2016 of the new five-year plan. Although this is a positive step, the use of an ETS to put a price on China’s greenhouse gas emissions may not be the most effective policy instrument available.

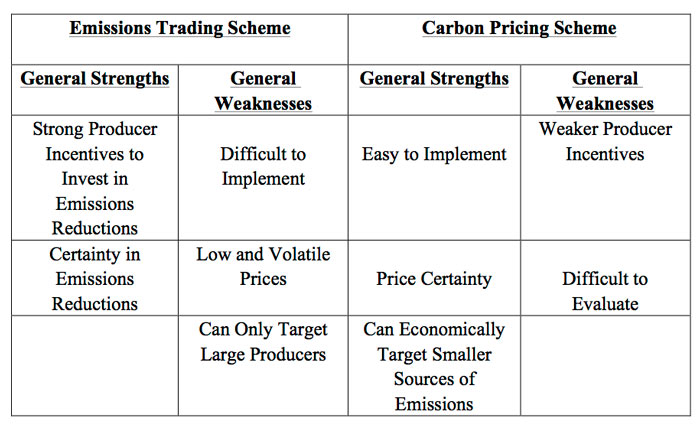

In addition to this planned national ETS scheme, we would suggest that China’s emissions abatement also could benefit from the implementation of a national carbon tax. Though the carbon tax suffers from the ‘tax’ label there are significant advantages to – let us call it – a carbon pricing scheme (CPS). A CPS allows a price to be attached to various sources such as private transportation that are too small and numerous to be targeted by an ETS. Since ETS are designed to restrict the emissions of large producers, they lack the ability to alter public consumption patterns. Conversely, a CPS does not possess the incentive structure generated by an ETS, which allow big polluters to sell their excess credits to finance their own emissions reduction. In addition, ETS and CPS differ: while a CPS allows for price certainty, it is much easier to see how much emissions have been reduced through the ETS as there is a set cap on emissions.

Generally, a carbon tax appears to function more effectively than a carbon trading system. The complexities of an ETS, with its auctions, grandfathering, and reserve mechanisms, make it difficult to implement. ETS schemes have shown that they are vulnerable to price volatility. ETS schemes are also open to bureaucratic manipulation – officials benefiting their friends with credits that diminish the overall effectiveness of the trading scheme.

Carbon Pricing Schemes

CPS schemes are relatively simple and the prices may be set to any value the policy-maker desires. Price stability provides incentives for greater reductions in emissions as past research has shown that firms are more likely to invest in emissions abatement for their firm if they perceive consistency in future carbon prices. ETS schemes, in particular, have been plagued with issues of oversupply and have failed to create high enough carbon prices. According to the 2014 World Bank Carbon Pricing Report, the European Union Emissions Trading Scheme – which most suggest is the most successful ETS scheme to date – maintained a price of only $9 per ton of CO2 equivalent. In comparison, carbon pricing managed to set emission prices at $16 in Britain per ton of CO2 equivalent, $31 in Denmark, $48 in Finland, and $168 in Sweden. Indeed, not a single national or transnational ETS anywhere in the world has been able to achieve an average carbon price of over $10 in the 2013-2014 period and the Chinese pilots are no exception. From the respective starting dates of the pilot programs until April 2014, carbon prices in the Chinese pilots failed to even reach a national average of $6.

In the Chinese case, the pilots have revealed problems that may reappear while implementing a national ETS. The infrastructure for the ETS is simply inadequate. Chinese officials and academics associated with the pilot projects have noted that trading within the pilot programs are low. The lack of resources allocated to the credit exchanges has been cited as a key cause of this issue, but the problem remains to be resolved. An ETS scheme is intended to enact a price for the externality of greenhouse gas and create efficient emissions reduction through the distributive effects of an open market, the effectiveness of which depends upon a high carbon price and a high degree of liquidity within the carbon market.

If China were to move to implement a formal CPS, however, these problems can be mitigated. Trading volumes and credit exchange infrastructure are no longer concerns if the price is applied directly to the carbon emitters. A low price for emissions can easily be overcome. Policy makers in that situation can simply raise the carbon price. Carbon pricing in fact is well suited to China. Emitters’ expectations of future carbon price increases can be established through broad policy announcements as long as the government maintains a transparent position on its future plans for carbon pricing.

There is little likelihood of the environmental policy being repealed due to a change of government, as was the case in Australia. Climate change is not a publicly contested issue in China and the Chinese one-party system makes established revenue streams difficult to remove due to bureaucratic inertia. Since firms can expect the tax to continue barring some economic catastrophe, investment in technology and other means to reduce emissions can be made without fear of these investments becoming pointless due to a policy change.

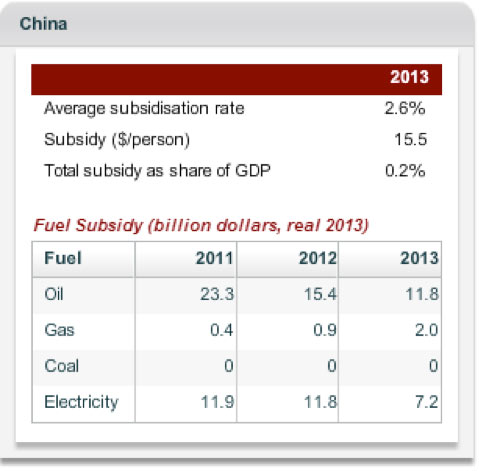

Moving forward, China should repeal its subsidies on energy before implementing a CPS to ensure that the CPS will actually raise the cost of polluting. Although there is no consumer subsidy on coal, there was a $2 billion subsidy for gas and $11.8 billion subsidy for oil in 2013. For the fuels themselves, cutting the subsidies first and then implementing a CPS would be a prudent measure. In addition, electricity prices in China are fixed. This works in favour of the ETS because it forces electricity producers to pursue lower emissions instead of hiking up electricity prices.

Windfall profits generated by passing prices onto consumers can break the incentive structure that would otherwise lead electricity producers to invest in emissions reductions. Moreover, household electricity consumption is hard to change with prices adjustments and the Chinese ETS design already captures industrial use of electricity. As such, the electricity pricing system should remain fixed. Nonetheless, there remains an existing subsidy of $7.2 billion (2013 figure) and electricity prices should be raised to eliminate this subsidization of consumer costs. Altogether the subsidization rate in China is fairly low. The 2.6% subsidy is not a high figure compared to Southeast Asian countries and very miniscule compared to South Asia, Russia and Latin America. Considering the small scale of the subsidies, ending them and transitioning from subsidizing energy to imposing carbon pricing should not have severe economic repercussions.

Table from the International Energy Agency

Final Thoughts

In China’s case a carbon pricing scheme can be an effective policy addition to an ETS scheme in reducing carbon emissions. However, to take full advantage of such a policy, China would need to streamline its fiscal revenue system. In the meantime, it may be prudent to consider the implementation of both a national ETS scheme a carbon-pricing scheme. As the national ETS scheme begins its operation in 2016, the policy alternative of carbon pricing should be studied and on stand-by to supplement or replace the new Chinese ETS if, as is anticipated, the ETS finds difficulties in operation and effectiveness.

Note: This piece relies upon Chinese stats, which remain at an early stage of reconciliation and may or may not contain some inaccuracies.